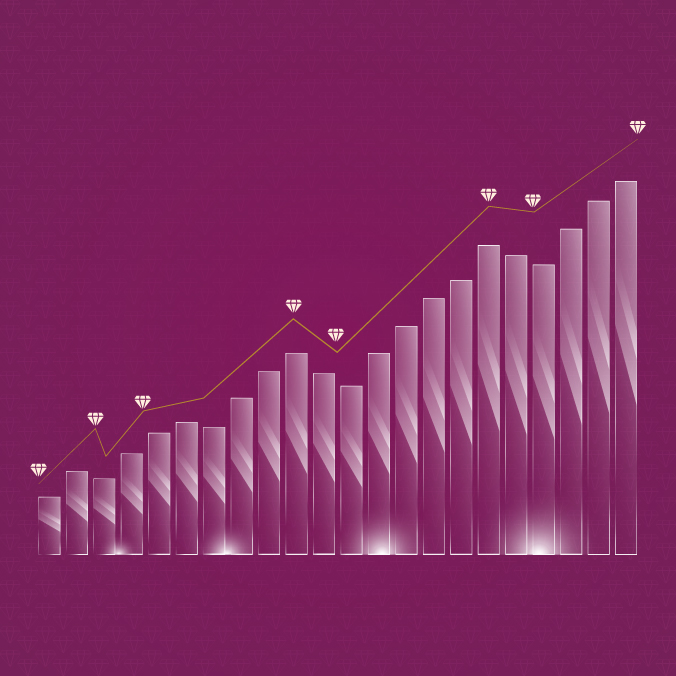

The decade that the diamond industry has been waiting for has arrived

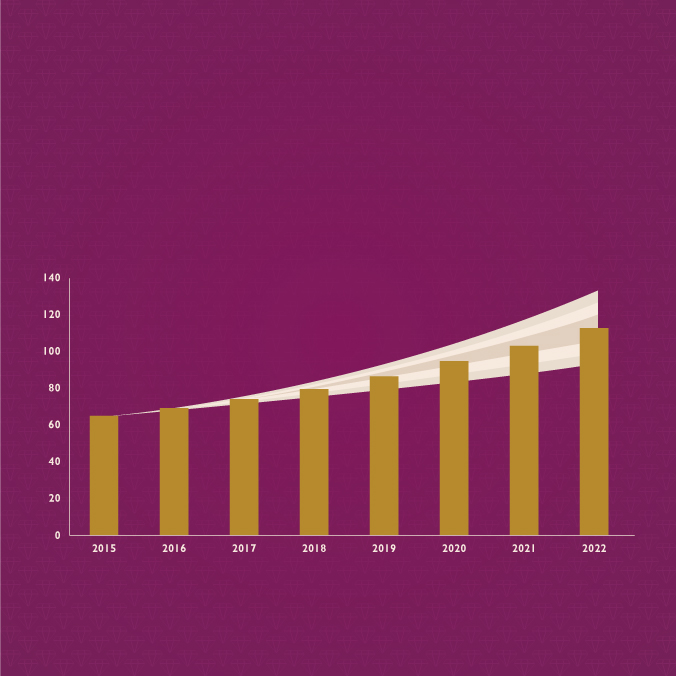

The global diamond jewelry retail industry saw a downswing but fared much better than the overall personal luxury market notes a recent report on the global diamond industry. The report by the Antwerp World Diamond Center (AWDC) and Bain & Company underlined that the revenues decreased by 15%, in some cases up to 33%, driven by lower diamond jewelry sales due to lockdowns, travel restrictions, and economic uncertainty. However, the fourth quarter of 2020 saw the demand picking up with it coinciding with the holiday season across the globe.

An interesting development in the Indian market

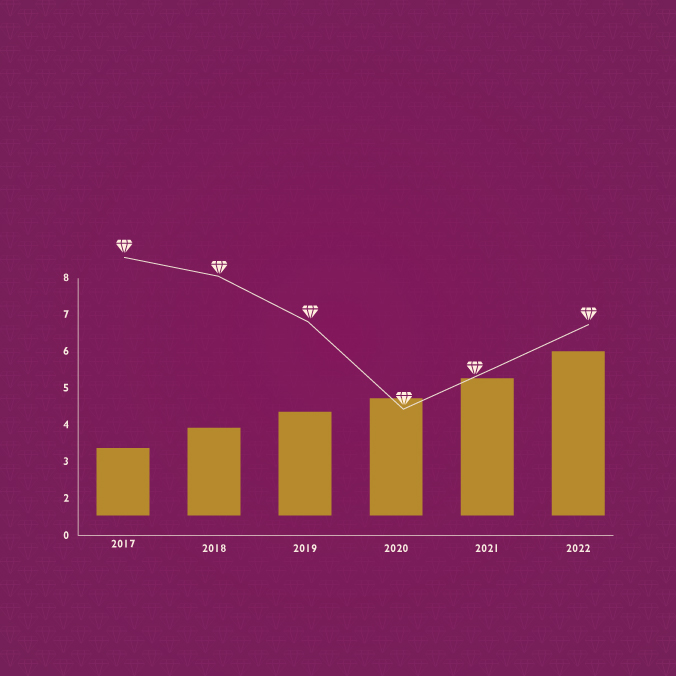

In India, the upswing was, even more, stronger post the second wave given the extended wedding season and pent-up shopping demand. Conversations with our customers revealed that a small wedding, mandated by the government regulations, translated into more money being available. Money that was typically allotted for wedding venues and food was now available for jewelry spending. At Sunny Diamonds, these factors were instrumental in driving our growth. In fact, we witnessed a 34.01% jump in the third quarter of 2021-22 compared to the same period in 2019-20.

Forward to the present day, the diamond jewelry industry is said to witness a further boost with the Indian government making Hallmarking mandatory. The move is likely to induce a year-on-year growth of 15% with the organized players witnessing a higher-than-industry growth of more than 20%.

In addition, in the Union Budget 2022, the government announced the reduction of import duty on cut and polished diamonds and gemstones. The customs duty on polished diamonds and gemstones has also been reduced from the existing 7.5% to 5%, and sawn or rough diamonds would not attract any duty. All of this is propelling growth in the domestic diamond industry, even amidst a volatile environment sparked off by the pandemic.

A strong growth engine

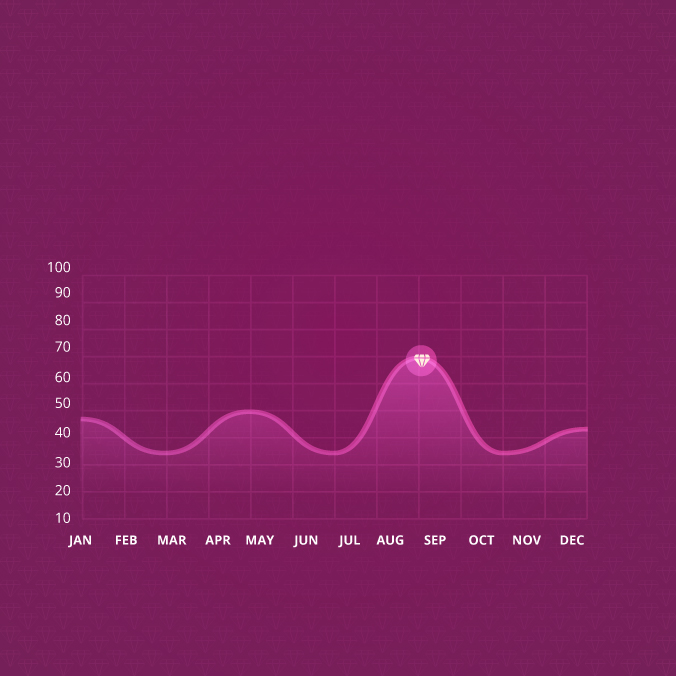

But, there are two other bigger reasons why the diamond retail jewelry market has been able to drive growth amidst a challenging market. One key reason is that the pandemic saw an acceleration in digitization. Diamond Jewelry, like many other sectors, took to the online route stronger than ever before. While we went online as early as 2016 and piloted features like ‘Try From Home’ in 2018, we strengthened our e-commerce offering during the early months of the pandemic. A strong push factor was a clear boost in the site traffic, given that people were now not only adopting technology but were getting comfortable with it even for purchasing luxury products. And, that saw us launching new initiatives. For instance, we enabled the scheduling of video calls for customers to take a closer look at the products that they shortlisted or added to their wishlist from our e-commerce portal. We also were able to take customization requests online and deliver on our promise.

The other big reason is an evident shift in consumer perception about diamond jewelry – an observation that a customer sentiment survey issued by Bain in 2020 confirms. It stated that in the US, China, and India, 60% to 70% of respondents believed that diamonds were an essential part of a marriage engagement and that after the pandemic, 75% to 80% of consumers intended to spend the same amount or more on diamond jewelry than they would have before the crisis. The bridal market which was traditionally dominated by gold jewelry is witnessing a significant uptake in diamond jewelry. That said, interestingly, there is a contrasting trend led by Gen Z and millennials who no longer want diamond jewelry dictated to occasion wear. That’s why Gen Z and millennials have been increasingly seen investing in minimalistic and everyday wear diamond jewelry. They see diamond jewelry complementing their personality and defining their individual style. The evolving customer preferences, growing purchasing powers, innovation in jewelry design, and the opportunity to expand retail diamond jewelry footprint in emerging economies are sending a positive signal to the industry.

The shimmer looks promising

It’s not easy to weather a cautious market, more so a pandemic. The challenge is bigger for the luxury sector, making recovery an uphill climb. But, what’s even more amazing is to be able to bolster growth amidst volatility. This is what the diamond industry has been able to achieve in the last 24 months. The recovery, revival, and growth are a clear indication that the long-term outlook for the diamond jewelry market is positive. It could well be the decade that we as businesses in the industry have been waiting for.